New Fund- Sabadell Evolución 01 2030, FI

A balanced fixed income Fund with a buy-and-hold strategy

Sabadell Evolución 01 2030, FI is a balanced fixed income Fund. The exposure to public and private fixed income will be over 70%, investing mainly in bonds with maturities equal to or shorter than the Fund's time horizon. More than 60% of this exposure is to bonds with investment grade credit ratings (i.e. with a minimum rating of BBB-, or equivalent, at the time of purchase). A small portion of the portfolio, typically around 0.70% (maximum 1%) of its net assets, is allocated to purchase options on European stock indices, with the aim of obtaining additional appreciation, but the total equity exposure does not exceed 30%.

The Fund's portfolio has a predefined term of just over four years, with a time horizon of 31 January 2030. This allows investors to plan their financial needs.

The fixed income portfolio offers a level of expected return that we believe remains attractive relative to current market interest rates. In addition, it aims to take advantage of exposure to the stock market, through a limited risk option strategy.

Sabadell Evolución 01 2030, FI is managed with the objective of achieving capital appreciation in line with the assets in which it is invested during the recommended holding period.

Risks of the Fund

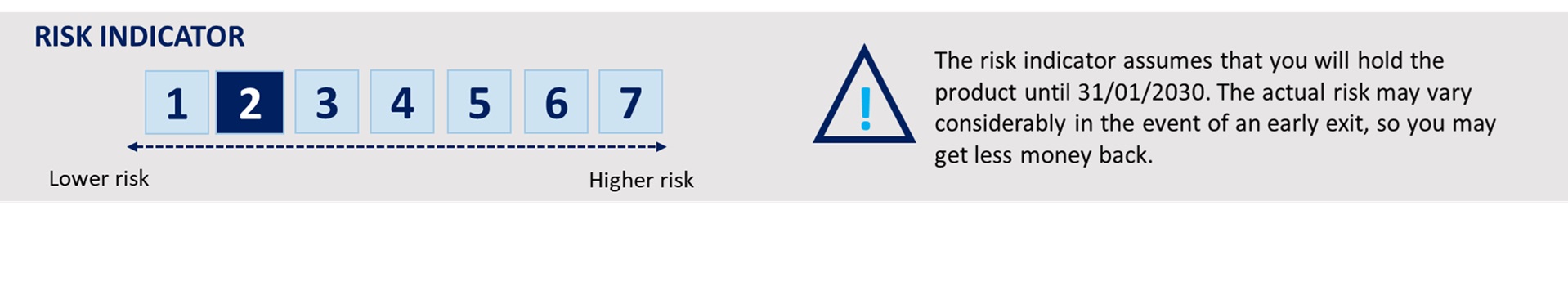

The summary risk indicator is a guide to the level of risk of this product compared to other products. It shows how likely it is that the product will lose money because of market movements or because we are unable to pay you.

We have rated this product at risk level 2 on a scale of 7, where 2 means low risk. This assessment rates the possibility of suffering a loss in future returns as low and the likelihood of a bad market situation influencing our ability to pay you as very unlikely.

Additional risks: Market liquidity risk, as investment in small-cap securities and/or markets with small size and limited trading volume may deprive investments of liquidity, which may adversely affect the price conditions under which the Fund may be forced to sell, buy or modify its positions. Sustainability risks, in the event of the occurrence of an environmental, social or governance event or condition that may cause an actual or potential material adverse impact on the value of an investment; depending on the Fund's exposure to the affected securities, the impact of unmitigated or residual sustainability risks may have varying levels of severity on the Fund's performance.

This product does not include any protection against future market developments and you may lose some or all of your investment. In addition to the risks included in the risk indicator, other risks may affect the Fund's performance, such as credit risk. Please refer to the prospectus of Sabadell Evolución 01 2030, FI.

This product cannot be readily realised. Fixed income investments made by the Fund would be subject to losses if interest rates rise. If you choose to exit before the end of the recommended holding period you may not get back your full investment and may have to pay additional costs.

This Fund may invest up to 40% in fixed income issues of low credit quality and therefore has a high credit risk.

Any redemptions made prior to 31 January 2030 will incur a redemption charge of 2% unless ordered on one of the 16 dates specifically provided for.

Sabadell Evolución 01 2030, FI is registered with the CNMV under number 5972 and ISIN code ES0179608007. The decision to invest in the Fund should take into account all the characteristics or objectives of the Fund. For a more detailed description of the Fund's characteristics and investment policy, the minimum initial investment, the recommended investment period, information on costs, charges and other expenses and, in particular, the risks associated with the Fund, we recommend reading the prospectus and the Key Information Document, available at sabadellassetmanagement.com.

This Fund is a non-complex MiFID product.

The management company is Sabadell Asset Management, S.A., S.G.I.I.C., Sociedad Unipersonal, registered with the CNMV under number 58. The depositary is BNP Paribas S.A. Sucursal en España, registered with the CNMV under number 240.