Renewal of the Sabadell 12M Garantizado guarantee

Fund with daily guarantee

The guarantee of the Sabadell 12M Garantizado Fund expires on 30 May 2025 and Amundi has decided to extend the guarantee period by one more year.

During the period from 30 May 2025 to 30 June 2025 inclusive, the Fund will benefit, on a daily basis, from the guarantee that each net asset value will be at least equal to the previous net asset value. During this period, there will be a change in the investments of the Fund's portfolio. In addition, from 1 July 2025 to 29 May 2026 inclusive, Amundi guarantees 100% of the initial investment, valued at 30 June 2025, and an additional return, net of recurring costs, which is not guaranteed and which can be compared with that of the capitalised €STR index.

Unitholders who wish to remain in the Fund do not need to take any action themselves. They may also increase their investment by subscribing for new units from 1 June until 30 June 2025. After the latter date, the Fund will be closed to new subscriptions. On the other hand, for those who prefer to redeem, in whole or in part, or to transfer their units, they may continue to do so at any time and free of charge.

Sabadell 12M Garantizado will accept new subscribers throughout the initial marketing period, i.e. from 1 June to 30 June 2025.

Below, you can consult the official communication sent and approved by the AMF (French regulator).

Risks of the Fund

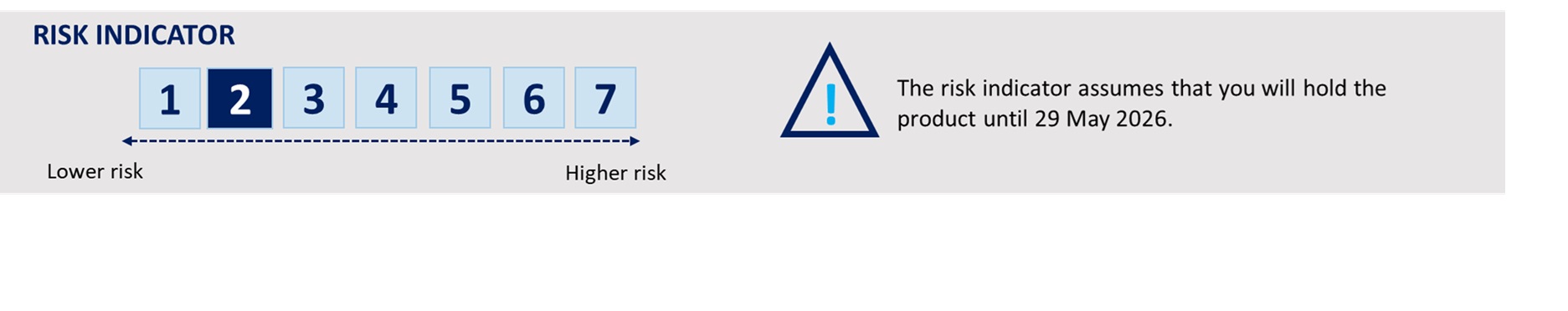

The summary risk indicator is a guide to the level of risk of this product compared to other products. It shows how likely it is that the product will lose money because of market developments or because we are unable to pay you.

We have classified this product in risk class 2 on a scale of 7, where 2 means low risk. This assessment rates the possibility of suffering losses in future returns as low and the likelihood of a bad market situation influencing our ability to pay you as very unlikely.

Additional risks: The liquidity risk associated with reverse repurchase agreements (repos) or total return swap (TRS) contracts could increase the variance of the product's performance.

In addition to the risks included in the risk indicator, other risks may affect the Fund's performance. Please refer to the prospectus of Sabadell 12M Garantizado.

The use of complex products, such as derivatives, can lead to increased movement of securities in your portfolio.

The Fund's guaranteed return does not protect investors from the effect of inflation over the life of the Fund until maturity so that the real return (i.e. discounting inflation) could be lower or even negative.

Fixed income investments made by the Fund would incur losses if interest rates rise, so redemptions made before maturity may result in losses to the investor.

Sabadell 12M Garantizado (ISIN Code: ISIN FR001400O747), managed by Amundi Asset Management, is a French Investment Fund or FCP, by its French acronym "Fond Commun de Placement", registered and supervised by the AMF (Autorité des Marchés Financiers, French regulator) and registered with the CNMV under number 2250 for marketing in Spain. A summary of information on investor rights and collective redress mechanisms is available in English at: https://about.amundi.com/Metanav-Footer/Footer/Quick-Links/Legal-documentation . The Management Company may cease to market the Fund in any EU member state in which it has given notice to market the Fund. The decision to invest in the Fund should take into account all of the Fund's features or objectives. For a more detailed description of the Fund's features and investment policy, the minimum initial investment, the recommended investment period, information on costs, charges and other expenses and, in particular, the risks related thereto, we recommend reading the prospectus and the Key Information Document, available at sabadellassetmanagement.com.

This Fund is a non-complex MiFID product.

The Guarantor is Amundi, S.A. The Management Company is Amundi Asset Management, Société par Actions Simplifiée, Société de Gestion de Portfolios authorised by the AMF under no. GP 04000036. Registered office: 91-93, Boulevard Pasteur - 75015 Paris. The Custodian is CACEIS Bank, Société Anonyme. Registered office: 89-91 rue Gabriel Péri - 92120 Montrouge.