Sabadell Garantía Fija 21, FI

A Guaranteed Fixed Return Fund

Sabadell Garantía Fija 21, FI guarantees, on maturity of the guarantee, that you will recover 100% of the initial investment, valued at 21 July 2025, and a return of +1.56% APR*.

Cost-effectiveness will be achieved as follows:

- On 25 November 2025, 2026 and 2027: A mandatory redemption of a fixed amount of+ 1.30% of the investment valued on 21 July 2025, adjusted for any redemptions and/or voluntary transfers, will be made.

- On 27 November 2028: You will receive an additional appreciation of +1.30% on the investment as at 21 July 2025, adjusted for possible redemptions and/or voluntary transfers.

The guarantee is set to expire on 27 November 2028.

Sabadell Garantía Fija 21, FI is an investment alternative especially suitable for more conservative investors who wish to receive a fixed return without assuming risk on the amount invested on maturity of the guarantee.

*APR of 1.56% guaranteed for units subscribed on 21 July 2025 and held until 27 November 2028, adjusted for any redemptions and/or voluntary transfers (any redemptions or transfers of units - excluding compulsory redemptions - made before 27 November 2028 will mean that the value of the initial investment will not be guaranteed for the portion redeemed or transferred and that the net asset value on the date of application and, where applicable, the redemption fee will apply). Fixed income investments made by the Fund will incur losses if interest rates rise and therefore redemptions made before the maturity of the guarantee may result in losses to the investor. Despite the existence of a guarantee, there are clauses conditioning its effectiveness which can be found in the "Performance Guarantee" section of the prospectus.

Risks of the Fund

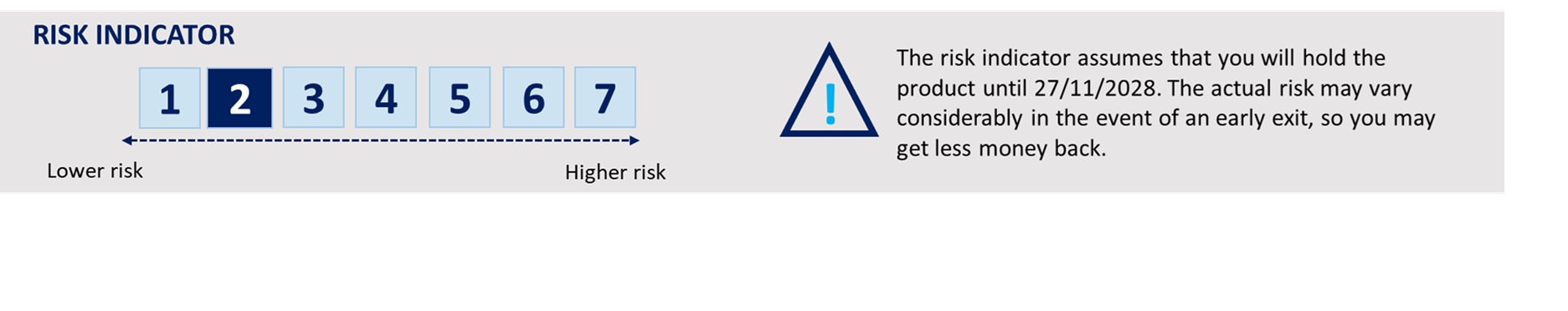

The summary risk indicator is a guide to the level of risk of this product compared to other products. It shows how likely it is that the product will lose money because of market developments or because we are unable to pay you. We have rated this product at risk level 2 on a scale of 7, where 2 means low risk. This assessment rates the likelihood of suffering a loss in future returns as low and the likelihood of a bad market situation affecting our ability to pay you as very unlikely.

Additional Risks: Sustainability risks, in the event of an environmental, social or governance event or condition that may cause an actual or potential material adverse impact on the value of an investment; depending on the Fund's exposure to the affected securities, the impact of unmitigated or residual sustainability risks may have varying levels of severity on the Fund's performance.

In addition to the risks included in the risk indicator, other risks may affect the Fund's performance. Please refer to the prospectus of Sabadell Garantía Fija 21, FI.

You are entitled to get back at least 101.30% of your invested capital on the maturity date and the amount corresponding to 1.30% of your investment on 25 November 2025, 25 November 2026 and 25 November 2027. Any amount above this amount and any additional returns will depend on future market developments and are uncertain.

This product is not easily redeemable. If you choose to disinvest before the recommended holding period has elapsed, there is no guarantee and you may not get back your full investment and may have to pay additional costs.

There are periods during which redemption fees do not apply and these can be found in the prospectus. Any redemptions made prior to the maturity of the guarantee will incur a redemption fee of 2%, except if ordered on one of the 11 dates specifically provided for in the prospectus or if they are the mandatory redemptions set out in the prospectus.

During the initial marketing period the Fund is permitted not to value a portion of its transactions and therefore the net asset value of units may experience a material change on the first valuation day (22 July 2025). Please note that the estimated performance of the Fund does not protect investors from the effect of inflation during the period to maturity and therefore the actual performance (i.e. net of inflation) may be lower or even negative.

-------------------------------------------------------------------------------------------------------------------------------

Sabadell Garantía Fija 21, FI is registered with the C.N.M.V. under number 5751. The decision to invest in the Fund should take into account all the characteristics or objectives of the Fund. For more detailed information on the Fund's characteristics and investment policy, the minimum initial investment, the recommended investment period, information on costs, charges and other expenses and, in particular, the risks related thereto, we recommend reading the prospectus and the Key Information Document, available at sabadellassetmanagement.com.

This Fund is a non-complex MiFID product.

The management company is Sabadell Asset Management, S.A., S.G.I.I.C., Sociedad Unipersonal, registered with the CNMV under number 58. The depositary is BNP Paribas S.A. Sucursal en España, registered with the CNMV under number 240.